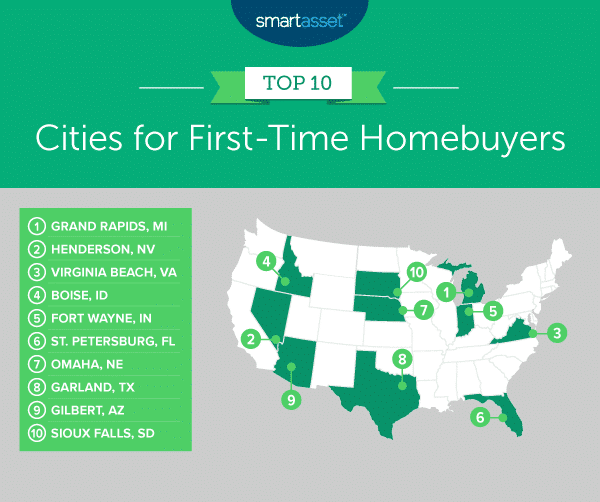

What’s the best city for first time homebuyers?

Texas – North Texas, in particular – has something to say about that, according to a recent study from SmartAsset.

Garland, Frisco, Irving, Arlington, Plano and McKinney crack the top 30 cities for first-time homebuyers.

With mortgage rates at all-time lows and the personal saving rate remaining relatively high after a spike in April, now may be a good time for considering homeownership.

Here’s SmartAsset’s 411 on No. 8. Garland: Garland, Texas ranks 13th for the category home market favorability and third in the category of employment. Census data from 2018 shows that the ratio between the median valued home and median annual rent in Garland was 12.62, the 27th-best in our study. Additionally, between 2013 and 2018, the median home value increased by about 56%, the fourth-highest increase of any city in our top 10 and 44th-highest overall. Regarding job opportunities, the July 2020 unemployment rate (8.1%) is the 35th-lowest and the five-year change in median household (almost 32%) is the 26th-highest. With incomes rising, individuals may be able to put more money toward their savings and potential down payment.

Frisco and Irving come in at No. 11 and No. 12 respectfully. Arlington came in at No. 18 and Plano at No. 24.

To find the best cities for first-time homebuyers , SmartAsset analyzed data on 12 metrics across four major categories: home market favorability, affordability, livability and employment.

U.S. long-term mortgage rates changed little the week of Oct. 8, flattening in recent weeks following a year-long decline amid economic anxiety in the recession set off by the coronavirus pandemic. Home loan rates have remained at historically low levels.

Mortgage buyer Freddie Mac reported Oct. 8 that the average rate on the 30-year loan eased to 2.87% from 2.88% last week. By contrast, the rate averaged 3.57% a year ago.

The average rate on the 15-year fixed-rate mortgage ticked up to 2.37% from 2.36%.

The low borrowing rates have bolstered demand by prospective homebuyers, who on the other hand have been constrained by the scarcity of available homes for sale.

In the latest sign of the flagging economic recovery and continued elevated level of job cuts, the government reported Oct. 8 that the number of Americans seeking unemployment benefits fell slightly last week to a still-high 840,000.Americans considering homeownership to take a serious look at their options.

For more on the SmartAsset report:

https://smartasset.com/mortgage/best-cities-for-first-time-homebuyers-2020