The sight of bluebonnets poking through the ground signals spring and typically means the start of peak home buying season.

But there is nothing typical about the Texas and Dallas-Fort Worth housing market again this year.

Dallas-Fort Worth continues to be one of the strongest housing markets in the United States because of its robust economy, abundant job opportunities and booming population growth.

But the factors that make Dallas-Fort Worth a magnet for newcomers are continuing to hamstring newcomers, middle-income and first-time buyers hoping to take advantage of favorable interest rates to nab a piece of the American dream.

“We’re still seeing the same thing we’ve seen the last few years,” said J.R. Martinez, president of the Greater Fort Worth Association of Realtors. “It’s very exciting to see all these people moving here, but unfortunately, it’s exciting and challenging at the same time.”

A persistent imbalance between supply and demand means that prospective buyers find themselves in bidding wars, paying over asking price and facing the disappointment of losing out to buyers with cash.

The competition is fiercest for buyers looking for affordable homes.

“There’s just not enough turnover in the resale market where you can find the most affordable houses,” Martinez said.

Martinez said he sees little change ahead in the existing home market, particularly with Dallas-Fort Worth leading the nation in population growth.

The Dallas-Fort Worth area toped the U.S. growth chart by adding 146,238 new residents, about 400 people per day, for the year ending July 1, 2017, the U.S. Census Bureau announced March 22. The Houston metro area was second with the addition of 94,417 new residents.

Four of the 10 top-gaining counties in Texas are in the North Texas area: Collin, Dallas, Denton and Tarrant. Bexar and Harris also made the top 10. DFW’s population grew from 7.25 million in 2016 to almost 7.4 million.

“Historically, the Dallas metro area attracts large numbers from both international and domestic migration,” Molly Cromwell, a demographer for the U.S. Census Bureau said in a statement. “Many of the other largest metro areas in the country rely mostly on international migration and natural increase for growth.”

The Census numbers mirror data in a report released by the Texas Association of Realtors last month showing Texas ranking second behind Florida for incoming residents in 2016. The state gained 531,996 newcomers that year.

About half the newcomers came from outside the U.S. From within the U.S., the highest number of transplants came from California (69,945), Florida (31,145), Oklahoma (30,532), Louisiana (27,998) and Illinois (21,848).

The Dallas-Fort Worth area recorded the highest number of out-state-residents at 123,661. The Houston area followed with 104,811 out-of-state relocations.

Booming population growth has dramatically impacted home sales and prices throughout Texas. Both sales and prices set new records for the third year in a row, according to Texas Association of Realtors’ recently-released 2017 annual report.

The report showed home sales increased 4 percent with 336,502 homes sold. The median sales price statewide rose 6.7 percent over 2016 to $223,990.

At the same time, inventory dipped to 3.1 months of supply in December. A market balanced between supply and demand has about 6.5 months of inventory, according to the Real Estate Center at Texas A&M University.

Despite another record year in sales, the third quarter of 2017 ended with a dip in sales, marking the first slide since the second-quarter of 2012.

Industry experts have long been forecasting that affordability of homes would eventually slow sales and erode Texas’ standing as top destination for relocations of businesses and individuals.

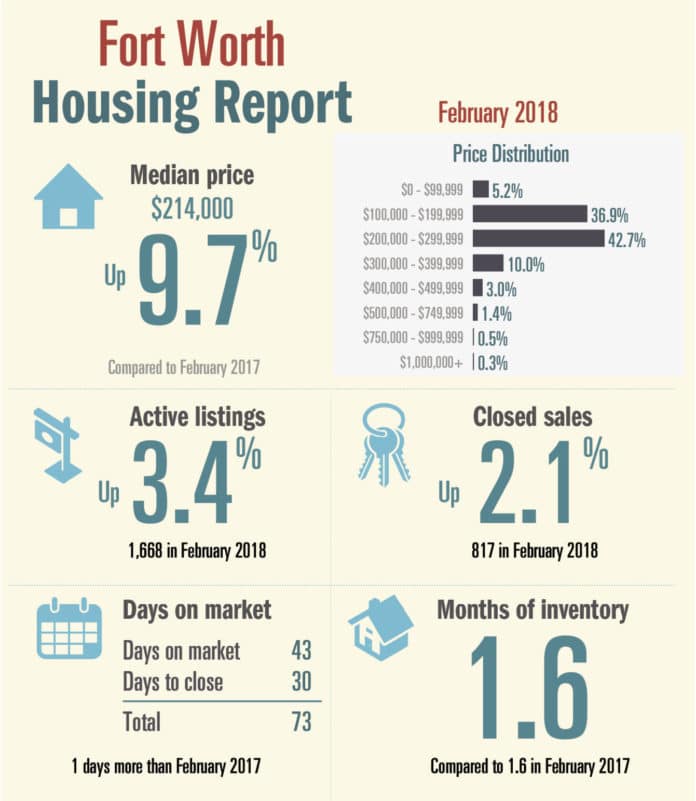

During February, 817 homes were sold, representing a sales increase of 2.1 percent over February 2017, according to the latest figures from the Greater Fort Worth Association of Realtors. At the same time, the median price for a home in Fort Worth increased 9.7 percent to $214,000 compared to February 2017.

Across Tarrant County, sales increased a marginal 0.1 percent while the median price rose 4.8 percent to $220,000 year-to-year in February.

Months of inventory remained unchanged from 1.6 percent year-to-year in Fort Worth and dipped from 1.6 to 1.5 months across Tarrant County during this period.

Low inventory is boosting prices as more buyers compete for too few homes.

An affordable home for a first-time homebuyer is $150,000, according to the Texas Real Estate Center.

Factoring in down payment, interest rates, taxes and utilities, 55.2 percent of Texas’ 9.54 million households could not afford a home priced at $200,000. About one-quarter of all Texans could not afford a home priced at $100,000.

In Fort Worth, 5.2 percent of houses sold in Fort Worth in February went for less than $100,000 and only 3.8 percent went for that amount in Tarrant County

Sales of homes priced from $100,000 to $200,000 accounted for 36.9 percent of the Fort Worth market and 35.4 percent of the Tarrant County market in February.

Low supply alone is problematic for would-be buyers who are able to identify homes available in their price range. Compounding the frustration is the huge volume of cash offers that are prevalent in the market.

“There are a lot of people who have sold homes and have cash to purchase homes and investors from countries like Mexico and China who want to invest in real estate,” said Martinez, who is a Realtor for Kenneth Jones Real Estate.

Martinez said sellers would rather take an offer of $150,000 in cash than a financed offer of up to $50,000 more.

“Sellers worry that financing won’t go through or the home doesn’t appraise for $200,000,” he said.

Typically pricier than resale homes, the new market offered some relief for prospective homebuyers, particularly in 2017.

Dallas-Fort Worth homebuilders started 33,891 homes in 2017, an increase of 4,488 houses or 15.3 percent above 2016 home starts of 29,403, according to a report from the housing analysis firm of Residential Strategies.

Homes priced between $250,000 and $500,000 increased by 3,623 units or 19.6 percent, according to the report as the homebuilding industry focused on affordability.

Yet, builders, who have to absorb increases in land, material and labor costs, find it hard to keep costs as low as they would like.

“Builders find it difficult increasingly difficult to produce new homes priced under $200,000. Over the past year, the number of new home starts under $200,000 has fallen by over 650 units,” according to the report.

Martinez said best selection of affordable new homes can be found in Johnson County and other places that still have a lot of low-cost rural land available.

Greg Green went that route after putting in at least eight offers in 2016 in the hopes of purchasing an existing home with two bathrooms for under $200,000.

The Tarrant County Sheriff’s deputy sold his Lake Worth home because it had only one bathroom and his elderly mother-in-law moved in with him and his wife.

“I couldn’t win a contract to save my life,” he said.

Finally, a friend tipped him off to a small new subdivision under construction in Azle.

“We got one of the last lots and had it built for $180,000,” Green said. “We’re happy with the house. It’s in a quiet neighborhood and we have a garage, which we didn’t have before.”

The only downside it takes a lot longer to get to work.