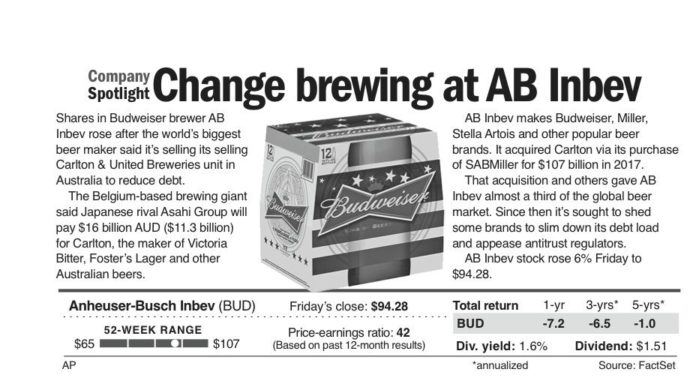

Shares in Budweiser brewer AB

Inbev rose after the world’s biggest

beer maker said it’s selling its selling

Carlton & United Breweries unit in

Australia to reduce debt.

The Belgium-based brewing giant

said Japanese rival Asahi Group will

pay $16 billion AUD ($11.3 billion)

for Carlton, the maker of Victoria

Bitter, Foster’s Lager and other

Australian beers.

AB Inbev makes Budweiser, Miller,

Stella Artois and other popular beer

brands. It acquired Carlton via its purchase

of SABMiller for $107 billion in 2017.

That acquisition and others gave AB

Inbev almost a third of the global beer

market. Since then it’s sought to shed

some brands to slim down its debt load

and appease antitrust regulators.

AB Inbev stock rose 6% Friday to

$94.28