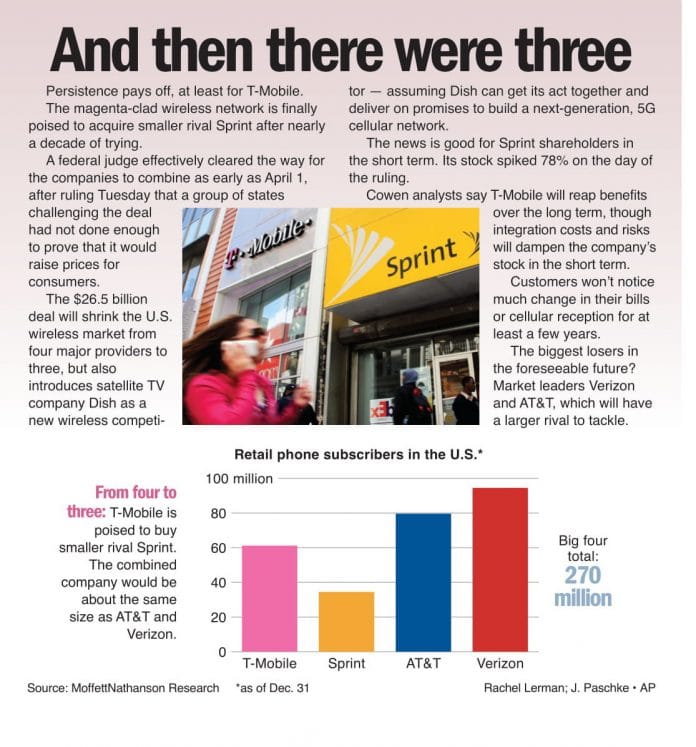

Persistence pays off, at least for T-Mobile. The magenta-clad wireless network is finally poised to acquire smaller rival Sprint after nearly a decade of trying. A federal judge effectively cleared the way for the companies to combine as early as April 1, after ruling Tuesday that a group of states challenging the deal had not done enough to prove that it would raise prices for consumers. The $26.5 billion deal will shrink the U.S. wireless market from four major providers to three, but also introduces satellite TV company Dish as a new wireless competitor — assuming Dish can get its act together and deliver on promises to build a next-generation, 5G cellular network.

The news is good for Sprint shareholders in the short term. Its stock spiked 78% on the day of the ruling. Cowen analysts say T-Mobile will reap benefits over the long term, though integration costs and risks will dampen the company’s stock in the short term. Customers won’t notice much change in their bills or cellular reception for at least a few years. The biggest losers in the foreseeable future? Market leaders Verizon and AT&T, which will have a larger rival to tackle.