Americans in small towns and rural communities are dramatically less likely to start new businesses than they have been in the past, an unprecedented trend that jeopardizes the economic future of vast swaths of the country.

The recovery from the Great Recession has been marked by a nationwide slowdown in the creation of start-up businesses. What growth has occurred has been largely confined to a handful of large and innovative areas, including Silicon Valley in California, New York City and parts of Texas, according to a new analysis of census data by the Economic Innovation Group, a bipartisan research and advocacy organization that was founded by the Silicon Valley entrepreneur Sean Parker and a small group of investors.

That concentration of start-up activity is unusual, economists say. In the economic recovery of the early 1990s, 125 counties combined to generate half the total new business establishments in the country. In this recovery, half the growth has been generated by just 20 counties.

The data suggest highly populated areas are not adding start-ups faster now than they did in the past; they appear simply to be treading water. But in rural areas, business formation has fallen off a cliff.

Economists say the divergence appears to reflect a combination of trends, all of which have harmed small businesses in rural America. Those include the rise of big-box retailers such as Walmart, the loss of millions of manufacturing and construction jobs across the country and a pull-back in business lending that appears to have stung small-town and rural borrowers particularly hard.

The figures reflect a fundamental shift over the past two decades in which workers and industries power the country’s economic growth. The shift gives an advantage to highly educated urbanites at the expense of everyone else. Polling suggests it is one of the driving forces in the political unrest among working-class Americans — particularly rural white men — who have flocked to Republican Donald Trump’s presidential campaign this year.

“Capital chases high-growth ideas, and high-growth ideas tend to be concentrated in areas of a highly educated and highly skilled workforce,” said Manuel Adelino, an economist at the Fuqua School of Business at Duke University who has published several research papers on entrepreneurship patterns and credit availability. “This suggests that the lack of new business formation in rural America may lead to widening gaps in income and employment” between those areas and big cities.

Other experts warn that the trends could be self-perpetuating and endanger the very life of rural economies in the years to come.

“It’s going to get much, much worse,” said John Lettieri, a former Republican congressional aide who is a co-founder of the Economic Innovation Group. “As bleak as these numbers are now, these may be the good years.”

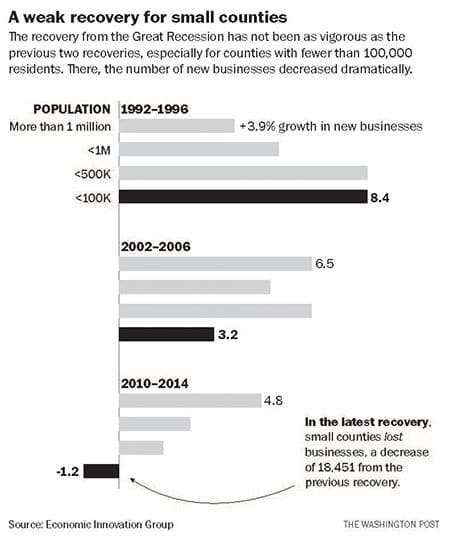

From 2010 through 2014, U.S. counties with 100,000 or fewer residents combined to lose more businesses than they created – despite a growing national economy and a falling unemployment rate. In the recovery that began in 1992, by comparison, those counties created a third of the nation’s net new businesses.

The smaller counties’ job creation rates have fallen off over the past three recoveries as well. In the ’90s recovery, less-populated counties accounted for more than 1 in 4 new jobs in the country. In the recovery that began in 2002, it was 1 in 5. In this recovery, it is less than 1 in 10.

Nearly two-thirds of rural counties lost businesses, on net, from 2010 to 2014. That is up from just over 2 in 5 counties in the early 2000s and just under 1 in 5 in the ’90s. The counties shedding establishments span the country and include almost every variety of rural areas, from farming and manufacturing communities in Missouri to coal-reliant swatches of Appalachia to coastal counties in the Pacific Northwest where the timber and fishing industries have dwindled.

Those findings confirm the deep geographic divisions in this recovery that other data have revealed.

Through the second quarter of this year, according to a Brookings Institution analysis of Moody’s Analytics data, America’s 100 largest metro areas had recovered all of the jobs they lost in the recession and added nearly 6 million additional jobs. The rest of the country, combined, was barely 300,000 jobs over its pre-recession peak.

What the innovation group’s analysis reveals is how concentrated business activity has become, even within metro areas. In many mid-size urban areas, such as the counties that include Tucson and Spokane, Washington, business formation rates have slowed in this recovery. The counties including two major Rust Belt cities, Cleveland and Detroit, have lost businesses, on net.

The concentration in part reflects the differences in the brand of entrepreneurship historically practiced in rural areas, compared with the higher-tech start-ups that have risen in recent decades. Recent research suggests there has been no decline in the formation rate for the Silicon Valley-style start-ups that economists generally consider to be “high growth,” which means the sort of companies that could sprout to employ hundreds or thousands of Americans.

The drop has come in the formation rate for other types of businesses, such as small manufacturers, construction firms and service establishments, such as restaurants. Those small businesses have traditionally served as critical vehicles for wealth-building and economic mobility in much of America. The sandwich shops of that world, as Adelino puts it, are struggling; Google-type start-ups are not.

Not surprisingly, then, the 20 counties that combined for half the country’s new business formation are almost entirely pillars of the innovation economy. They include the counties surrounding San Francisco, Los Angeles, New York, Miami, Austin, Dallas and Chicago.

Those areas contain higher-income, more highly educated workers who appear to have had a much easier time accessing capital — the infusion of money you need to start a business – in this recovery than have workers in the rest of the country.

After the Great Recession, lower-income borrowers were effectively shut out of credit markets, Adelino’s research shows, a finding supported by data from the Federal Reserve Bank of New York. Industry groups and many economists have warned that the Dodd-Frank financial regulation bill, passed in 2010, has forced smaller banks that often serve rural communities to tighten their lending.

Jason Furman, who chairs President Obama’s Council of Economic Advisers, says his research rejects that view. “There’s very little evidence that Dodd-Frank has reduced lending by community banks,” he said.

Previous economic transformations, such as the shift from farms to factories, have drawn Americans from rural areas into cities. Economists worry this case may prove more damaging, though, for workers, rural America and the country’s overall economic performance.

“New businesses are key to innovation, growth and jobs,” said Kenneth Rogoff, a Harvard University economist who advises the Economic Innovation Group. An increase in monopoly power from reduced competition, post-recession, he said, “is widely regarded as one of the major factors slowing innovation and weakening the quality of job growth.”