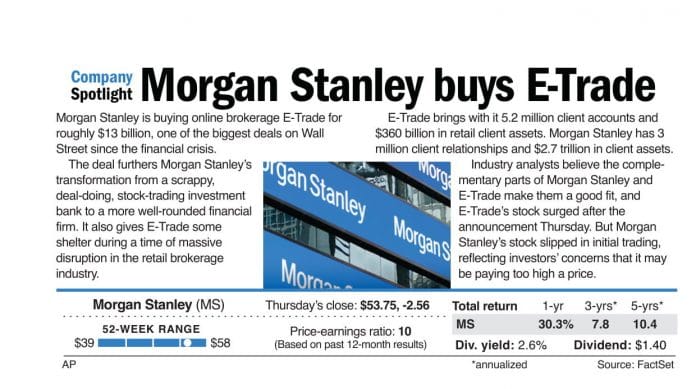

Morgan Stanley is buying online brokerage E-Trade for roughly $13 billion, one of the biggest deals on Wall Street since the financial crisis. The deal furthers Morgan Stanley’s transformation from a scrappy, deal-doing, stock-trading investment bank to a more well-rounded financial firm. It also gives E-Trade some shelter during a time of massive disruption in the retail brokerage industry.

E-Trade brings with it 5.2 million client accounts and $360 billion in retail client assets. Morgan Stanley has 3 million client relationships and $2.7 trillion in client assets. Industry analysts believe the complementary parts of Morgan Stanley and E-Trade make them a good fit, and E-Trade’s stock surged after the announcement Thursday. But Morgan Stanley’s stock slipped in initial trading, reflecting investors’ concerns that it may be paying too high a price.

AP